Notice regarding disruption of MSUT’s posted royalty distribution schedule:

In late September, MSU Technologies’ long-term Finance Coordinator resigned. We are recruiting for her replacement, however, in the interim, we must modify our posted royalty distribution schedule. We are focused on completing distributions each quarter, albeit later.

MSUT apologizes for the inconvenience and commits to returning to the established schedule as soon as possible. We appreciate your understanding during this transition. If you have questions or comments, please feel free to contact me at disante@msu.edu or 517-884-1826.

Anne C. Di Sante

Executive Director, MSU Technologies

November 28, 2023

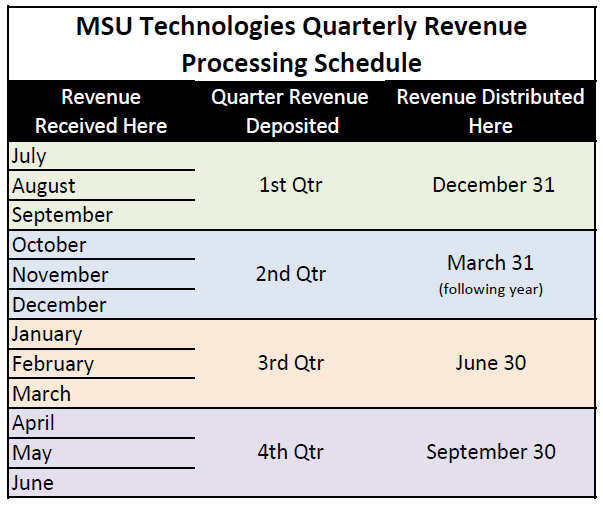

When an invention is licensed, inventors (authors) are entitled to a share of the revenues received by the University based on the MSU Patent Policy or Copyright Policy. MSUT will recover all direct expenses incurred prior to making distributions to inventors (authors). MSUT distributes revenues on a quarterly basis in the quarter following the quarter in which payment was received and deposited by MSUT (see graphic below). MSUT does not distribute revenue that it has not received.

Calculations for revenue distribution are done at the time we are ready to process the distributions. All distributions are made via electronic documents (edocs) in EBS. Inventors (authors) will receive notification that they will receive a revenue distribution payment from MSUT in one of two ways:

- If the inventor (author) is a current MSU employee: Once the edoc has been reviewed and approved in the MSUT office, the inventor (author) will be notified through the EBS system. Employees can log into the EBS system and open the edoc to view the distribution details. There will be an attachment in the ‘Notes and Attachments’ section of a PDF (includes the words ‘RD Worksheet’ in the title). This PDF gives detailed information on the distribution calculations. Payment will be made in the same manner you receive payroll payments after all required approvals have been made. You can track the status of the edoc by monitoring the route log in the edoc.

- If the inventor (author) is NOT a current MSU employee: An email notification will be sent to the inventor (author) once the edoc has been reviewed and approved in the MSUT office. Attached to the email will be the ‘RD Worksheet’ in PDF form, which gives detailed information on the distribution calculation. Payment will be sent via check to your home address on file unless you have made other arrangements with our office. It is your responsibility to keep MSUT updated on any address changes.

The inventor (author) is solely responsible for paying any and all applicable taxes on revenue distributions received. No taxes are withheld from the revenue distributions. Inventors (authors) will receive a 1099 from the University. Please consult a tax advisor for specific advice.

Please contact msutfin@msu.edu for any questions, address changes or other concerns you have regarding revenue distribution.